Buying or selling a house is not something people do every day. According to the National Association of Realtors’ 2021 Profile of Home Buyers and Sellers, the typical home seller moves every eight years. In spite of this, many homeowners think they know “how real estate works” and assume that their own prior experience or the experience of their friends and family provide the absolute playbook for every transaction. While many aspects of buying and selling remain the same, the industry has changed in a number of ways over the past few years.

Buying or selling a house is not something people do every day. According to the National Association of Realtors’ 2021 Profile of Home Buyers and Sellers, the typical home seller moves every eight years. In spite of this, many homeowners think they know “how real estate works” and assume that their own prior experience or the experience of their friends and family provide the absolute playbook for every transaction. While many aspects of buying and selling remain the same, the industry has changed in a number of ways over the past few years.

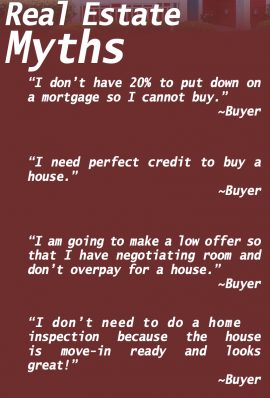

There is so much information available to consumers, but how much of that information is true? The abundance of information can be perplexing as well as downright inaccurate. These inaccuracies of information can often times cost you money and time which can result in you missing out on the house of your dreams.

In today’s fast-paced market, buying a house in desperation and neglecting to do your due diligence is a mistake. The property needs to be thoroughly vetted before purchasing. It takes knowledge, foresight and a good support system in your corner which includes your Realtor, lender and closing agent. Buyers need to be cautious with who they are taking advice from when it comes to putting together a smooth transaction.

For sellers, the instinct to “go for broke” in our current market can be tricky. Sometimes sellers end up over-improving to sell and lose money in the process. Additionally, listing a house far above market value can detract buyers and cause a loss of valuable time in the process.

Real estate transactions, whether buying or selling, are most likely the largest investment you will ever make and need to be handled properly and without fear of not knowing the facts. Please refer to the enclosed information to help dispel some of the misinformation that is out there.

If you’d like to know more, let’s have a conversation soon about how best to navigate your specific situation and the resources available to assist you.

“I don’t have 20% to put down on a mortgage so I cannot buy.”

It is not always necessary to put 20% down on a mortgage. The right amount depends on your current savings and your home buying goals. If you can buy a house with less money down and become a homeowner sooner, that’s often the right choice. Check out the pros and cons of each decision with a reputable, local lender.

“I need perfect credit to buy a house.”

Generally speaking, you’ll need a credit score of at least 620 in order to secure a loan to buy a house. That’s the minimum credit score requirement most lenders have for a conventional loan. With that said, it still may be possible to get a house with a lower credit score. A good loan officer can often give guidance on how to increase your score to put you in a more qualified buying position.

“I am going to make a low offer so that I have negotiating room and don’t overpay for a house.”

Historically, making an initial offer to purchase at a price lower than asking has been a well-used strategy to help gauge the seller’s willingness to negotiate. However, a low offer will not hold up to the current, fast-moving seller’s market we are in today. Be sure to put your best offer on the table to stay competitive with a better chance for success.

“I don’t need to do a home inspection because the house is move-in ready and looks great!”

Home inspections can uncover potentially life-threatening problems such as mold or faulty wiring. Sellers often prepare their home to sell by taking care of cosmetics but what lies beneath the exterior view is often where the most costly issues are both in expense as well as safety. Use the home inspection period to do your due diligence in vetting the property for everything from checking out the major systems to securing an insurance policy on the property.

“Renting is better and less risky than buying.”

In today’s fast-moving market, rental rates are rising at a rapid pace. Securing a fixed-rate mortgage ensures that your monthly house payment is constant and not based on inflation or the impulse of the landlord. While there are more expenses to cover when you own your own home, these are investments into the property that may garner a return if/when you sell.

“I am going to list my house above the market to be sure I have plenty of negotiating room.”

Listing at a fair value will bring more traffic and may result in multiple offers for you to choose from, netting you the best price and terms. It is fine to list at the high end of fair value, especially if there are comparative sales to support the price.

“I must renovate my kitchen and bathrooms before I sell so that I can get a higher price to pay for the renovations.”

It depends. You will need to decide which improvements will increase the home’s value and whether the expense is worth the change. There are some very low-cost improvements that may help you net a higher price such as fresh paint, improved lighting and enhanced curb appeal. Big-ticket items may not be the most feasible option because they do not always give the best return.

“A cash offer always trumps all other offers, right?”

Not necessarily. An all-cash offer for your home might seem like the golden ticket, but take the time to weigh all your options. Considerations such as price and closing dates can have an impact on your decision. Typically cash buyers look to close relatively fast and there may not be as much negotiating room when dealing with a cash buyer as opposed to one with lender financing. Be sure the buyer is pre-approved with a reputable lender for a smooth transaction.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link